Oaktree Specialty Lending Corporation

Oaktree Strategic Income Corporation

333 South Grand Avenue, 28th Floor

Los Angeles, CA 90071

Dear Stockholders:

You are cordially invited to attendparticipate in the 2018 Joint AnnualSpecial Meeting of Stockholders (the “Annual“Special Meeting”) of Oaktree Specialty Lending Corporation (formerly known as Fifth Street Finance Corp. through October 17, 2017, “OCSL”(“OCSL”), and Oaktree Strategic Income Corporation (formerly known as Fifth Street Senior Floating Rate Corp. through October 17, 2017, “OCSI”(“OCSI”, and each of OCSL and OCSI, a “Company” and together, the “Companies”) to be held virtually on April 6, 2018,June 28, 2019, at 10:00 a.m., Pacific Time at the following websites:

www.virtualshareholdermeeting.com/ocsl2018,ocsl2019sm for OCSL stockholders and

www.virtualshareholdermeeting.com/ocsi2018,ocsi2019sm for OCSI stockholders.

At the Special Meeting, stockholders of each Company will be asked to approve a new investment advisory agreement for each Company. Additionally, stockholders of OCSL only will be asked to approve the application of the reduced asset coverage requirements in Section 61(a)(2) of the Investment Company Act of 1940, as amended, to OCSL, which would permit OCSL to double the maximum amount of leverage that it is permitted to incur by reducing the asset coverage requirements applicable to OCSL from 200% to 150%. Stockholders of record of OCSL and/or stockholders of record of OCSI at the close of business on February 9, 2018May 6, 2019 are entitled to notice of, and to vote at, the AnnualSpecial Meeting or any adjournment or postponement thereof. Details of the business to be conducted at the AnnualSpecial Meeting are given in the accompanying Notice of Virtual Joint AnnualSpecial Meeting of Stockholders and 2018 joint proxy statement. The proposals are discussed in detail in the joint proxy statement, and each Company’s Annual Report for the fiscal year ended September 30, 2017 arewhich you should read carefully. The joint proxy statement is first being made availablesent to the respective stockholders thereof via the Internet on or about February 9, 2018.May 22, 2019. Your vote is very important to us.

Your Board of Directors unanimously recommends that you vote FOR the election of each of the nominees proposed by your Board of Directors and described in the accompanying joint proxy statement and FOR the proposal to ratify the appointment of Ernst & Young LLP as the independent registered public accounting firm for your Company for the fiscal year ending September 30, 2018. You can vote for your Board of Directors’ nominees and on the other matters to be voted on at the Annual Meeting by following the instructions on the Notice of Internet Availability of Proxy Materials and voting by Internet or telephone.EACH BOARD OF DIRECTORS, INCLUDING EACH OF THE INDEPENDENT DIRECTORS THEREOF, UNANIMOUSLY RECOMMENDS THAT YOU VOTE “FOR” THE PROPOSAL(S) THAT SUCH COMPANY’S STOCKHOLDERS ARE BEING ASKED TO APPROVE AS DESCRIBED IN THE ACCOMPANYING PROXY STATEMENT.

It is important that your shares be represented at the AnnualSpecial Meeting.

Please follow the instructions on the Notice of Internet Availability of Proxy Materialsenclosed proxy card and vote via the Internet, by telephone or telephone.by signing, dating and returning the enclosed proxy card. We encourage you to vote via the Internet as it saves us significant time and processing costs. However, the Notice of Internet Availability of Proxy Materials includes instructions on how to request a hard copy of the joint proxy statement and proxy card for the Annual Meeting free of charge, and you may vote your proxy by returning your proxy card to us after you request the hard copy materials. Voting by proxy does not deprive you of your right to participate in the virtual AnnualSpecial Meeting.

No matter how many or few shares in a Company you own, your vote and participation are very important to us.

Sincerely, | |

/s/ Edgar Lee | |

Edgar Lee | |

OCSL and OCSI Chief Executive Officer |

Important Notice Regarding the Availability of Proxy Materials for the Joint AnnualSpecial Meeting of Stockholders to Be Held on April 6, 2018.June 28, 2019.

This 2018 jointThe proxy statement and the OCSL Annual Report on Form10-K for the year ended September 30, 2017 areis also available at https://www.oaktreespecialtylending.com. This 2018 joint proxy statementwww.oaktreestrategicincome.com and the OCSI Annual Report on Form10-K for the year ended September 30, 2017 are also available at https://www.oaktreestrategicincome.com.www.oaktreespecialtylending.com.

OAKTREE SPECIALTY LENDING CORPORATION

OAKTREE STRATEGIC INCOME CORPORATION

333 South Grand Avenue, 28th Floor

Los Angeles, CA 90071

NOTICE OF VIRTUAL 2018 JOINT ANNUALSPECIAL MEETING OF STOCKHOLDERS

Online Meeting Only – No Physical Meeting Location

OCSL: www.virtualshareholdermeeting.com/ocsl2018ocsl2019sm

OCSI: www.virtualshareholdermeeting.com/ocsi2018ocsi2019sm

April 6, 2018,June 28, 2019, 10:00 a.m., Pacific Time

Dear Stockholders:

The 2018A Joint AnnualSpecial Meeting of Stockholders (the “Annual“Special Meeting”) of Oaktree Specialty Lending Corporation a Delaware corporation (formerly known as Fifth Street Finance Corp. through October 17, 2017, “OCSL”(“OCSL”), and Oaktree Strategic Income Corporation a Delaware corporation (formerly known as Fifth Street Senior Floating Rate Corp. through October 17, 2017, “OCSI”(“OCSI”, and each of OCSL and OCSI, a “Company” and together, the “Companies”), will be conducted onlineheld virtually on April 6, 2018,June 28, 2019, at 10:00 a.m., Pacific Time at the following websites:

www.virtualshareholdermeeting.com/ocsl2018,ocsl2019sm for OCSL stockholders; and

www.virtualshareholdermeeting.com/ocsi2018,ocsi2019sm for OCSI stockholders.

The Board of Directors of each Company has approved and unanimously recommends that stockholders vote FOR a proposal to approve a new investment advisory agreement between the Company and Oaktree Capital Management, L.P. (the “Adviser”), that will replace the current investment advisory agreement with the Adviser and will become effective at the closing of the Merger (defined below). As discussed in more detail in the accompanying proxy statement, Oaktree Capital Group, LLC, a Delaware limited liability company (together with its affiliates, “Oaktree”), the parent company of each Company’s current investment adviser, entered into an Agreement and Plan of Merger (the “Merger Agreement”) with Brookfield Asset Management Inc., a corporation incorporated under the laws of the Province of Ontario (together with its affiliates, “Brookfield”), pursuant to which, Brookfield will acquire a majority economic interest in Oaktree (the “Merger”).

The Companies are subject to the Investment Company Act of 1940, as amended (the “1940 Act”), which provides that any investment advisory agreement must terminate automatically upon its “assignment.” As used in the 1940 Act, the term “assignment” includes any transfer of a controlling block of outstanding voting securities of an adviser or the parent company of an adviser. Notwithstanding this definition, a transaction which does not result in a change of actual control or management of an investment adviser is not deemed an “assignment” for purposes of the 1940 Act. Oaktree has informed each Company’s Board of Directors that it does not believe the consummation of the Merger would be deemed an “assignment” of the current investment advisory agreement between each Company and the Adviser (each such agreement, the “Current Investment Advisory Agreement”), although such a determination is inherently uncertain. In accordance with the 1940 Act, however, the Current Investment Advisory Agreement for each Company automatically terminates upon its assignment. To prevent any potential disruption in Oaktree’s ability to provide services to each Company once an assignment is deemed to occur, whether as a result of the Merger or as a result of Brookfield exercising actual control over Oaktree, each Company is seeking stockholder approval of a new investment advisory agreement between each Company and the Adviser, (each such agreement, the “New Investment Advisory Agreement”). All material terms will remain unchanged from the Current Investment Advisory Agreement. If approved, each New Investment Advisory Agreement would become effective at the Closing and would remain effective following the conclusion of the Initial Period. If the Merger does not occur, the Adviser will continue to operate each Company pursuant to the Current Investment Advisory Agreement.

At the AnnualSpecial Meeting, in addition to transacting such other business as may properly come before the meeting and any adjournments and postponements thereof, the respective stockholders of each Company will considerbe asked:

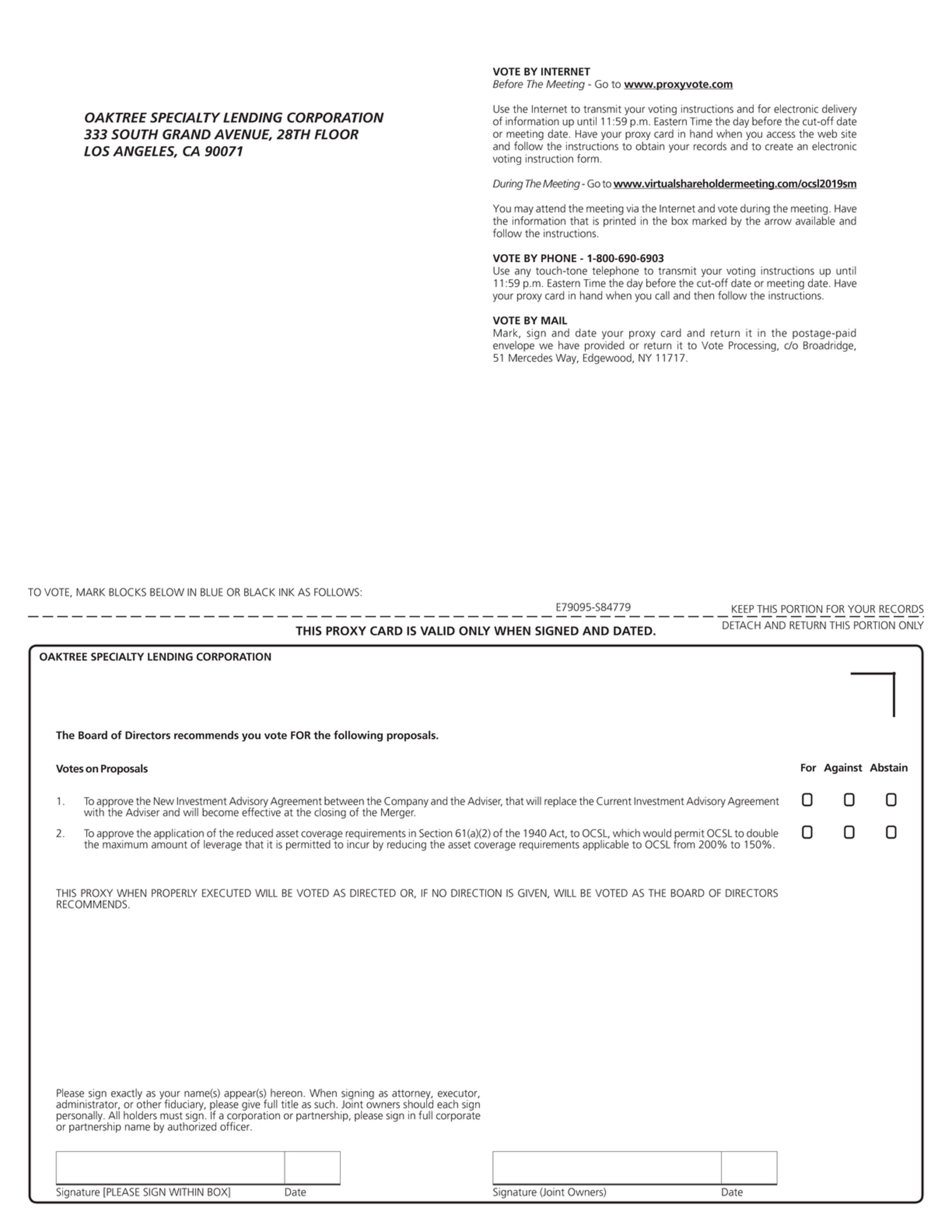

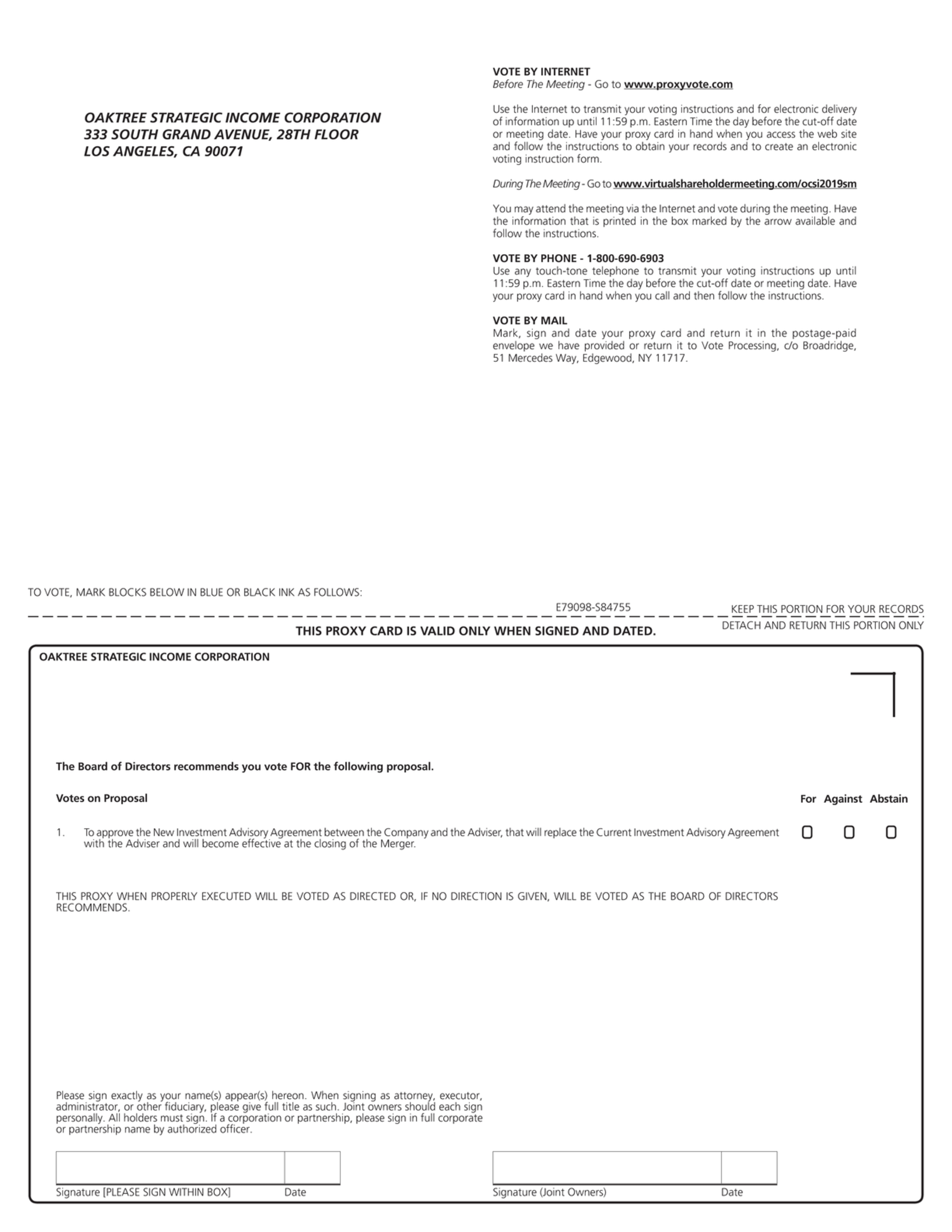

| 1. | to approve the New Investment Advisory Agreement between the Company and the Adviser, that will replace the Current Investment Advisory Agreement with the Adviser and will become effective at the closing of the Merger. |

In addition, the Board of Directors of OCSL has approved and unanimously recommends that the stockholders of OCSL vote FOR a proposal to approve the application of the reduced asset coverage requirements in Section 61(a)(2) of the 1940 Act to OCSL, which would permit OCSL to double the maximum amount of leverage that it is permitted to incur by reducing the asset coverage requirements applicable to OCSL from 200% to 150%. Pursuant to both the Current Investment Advisory Agreement and the New Investment Advisory Agreement, upon the effectiveness of the reduced asset coverage requirements to OCSL, the base management fee payable to the Adviser will be calculated at an annual rate of 1.50% of the value of OCSL’s total gross assets, including any investments made with borrowings, but excluding cash and cash equivalents; provided, however, the base management fee will be calculated at an annual rate of 1.00% of the value of OCSL’s total gross assets, including any investments made with borrowings, but excluding cash and cash equivalents, that exceeds the product of (i) 200% and (ii) OCSL’s net assets. Total base management fees, however, will increase if OCSL incurs additional leverage. For the avoidance of doubt, the 200% will be calculated in accordance with the 1940 Act and the exemptive relief OCSL received with respect to debentures issued by a small business investment company subsidiary.

At a meeting held on February 1, 2019, the following proposalsBoard of Directors of OCSL, including a “required majority” of OCSL’s directors, as defined in Section 57(o) of the 1940 Act, approved the application of the reduced asset coverage requirement in Section 61(a)(2) of the 1940 Act as being in the best interests of OCSL and its stockholders. Therefore, subject to certain additional disclosure requirements and provided such Company:approval is not later rescinded, the reduced asset coverage requirements will apply to OCSL effective as of February 1, 2020 (unless the proposal to approve the application of the reduced asset coverage requirements to OCSL is approved by OCSL’s stockholders at the Special Meeting, in which case the reduced asset coverage requirements will apply, and OCSL can incur additional leverage, effective the first day after such approval). If the proposal is not approved by the OCSL’s stockholders, OCSL currently intends to continue to operate within the 200% asset coverage requirements in accordance with its current investment strategy until February 1, 2020, provided the approval from OCSL’s Board is not rescinded prior thereto.

| 2. | to approve the application of the reduced asset coverage requirements in Section 61(a)(2) of the 1940 Act, to OCSL, which would permit OCSL to double the maximum amount of leverage that it is permitted to incur by reducing the asset coverage requirements applicable to OCSL from 200% to 150%. |

EACH COMPANY’S BOARD OF DIRECTORS, INCLUDING EACH OF THE INDEPENDENT DIRECTORS, UNANIMOUSLY RECOMMENDS THAT YOU VOTE “FOR” EACH OF THE APPLICABLEPROPOSAL(S) THAT SUCH COMPANY’S DIRECTOR NOMINEESSTOCKHOLDERS ARE BEING ASKED TO APPROVE AS DESCRIBED IN THE ACCOMPANYING JOINT PROXY STATEMENT AND “FOR” THE PROPOSAL TO RATIFY THE APPOINTMENT OF ERNST & YOUNG LLP AS THE INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR SUCH COMPANY FOR THE FISCAL YEAR ENDING SEPTEMBER 30, 2018.STATEMENT.

Your vote is very important to us. You have the right to receive notice of, and to vote at, the AnnualSpecial Meeting as to the OCSL proposals if you were a stockholder of record of OCSL at the close of business on February 9, 2018May 6, 2019 and as to the OCSI proposalsproposal if you were a stockholder of record of OCSI at the close of business on February 9, 2018. Each Company is furnishing aMay 6, 2019. A proxy statement andis attached to this Notice that describes the matters to be voted upon at the Special Meeting or any adjournment(s) or postponement(s) thereof. The enclosed proxy card to its respective stockholders on the Internet, rather than mailing printed copies of those materials to each of its stockholders. If you received a Notice of Internet Availability of Proxy Materials by mail, you will not receive a printed copy of the proxy statement and proxy card unless you request them. Instead, the Notice of Internet Availability of Proxy Materials will instruct you as to how you may access and review the proxy statement, and vote your proxy onvia the Internet.Internet, by telephone or by signing, dating and returning the enclosed proxy card.

Whether or not you plan to participate in the AnnualSpecial Meeting, we encourage you to vote your shares by following the instructions on the Noticeenclosed proxy card. Please note, however, that if you wish to vote during the Special Meeting and your shares are held of Internet Availability of Proxy Materials.record by a broker, bank, trustee or nominee, you must obtain a “legal” proxy issued in your name from that record holder.

We are not aware of any other business or any other nominees for election as directors of either Company, that may properly be brought before the AnnualSpecial Meeting.

Thank you for your continued support of Oaktree Specialty Lending CorporationOCSL and Oaktree Strategic Income Corporation.OCSI.

By order of the | ||

/s/ John B. Frank | ||

John B. Frank | ||

OCSL and OCSI Chairman |

Los Angeles, CA

May 21, 2019

February 9, 2018

Your vote is very important to us. To ensure proper representation at the AnnualSpecial Meeting, please follow the instructions on the Notice of Internet Availability of Proxy Materialsenclosed proxy card to vote your shares via the Internet, orby telephone, or by requesting, signing, dating and returning athe enclosed proxy card. Even if you vote your shares prior to the Annual Special Meeting, you still may participate in the virtual AnnualSpecial Meeting.

TABLE OF CONTENTS

Page | ||||||

| ||||||

| ||||||

Oaktree Specialty Lending Corporation

Oaktree Strategic Income Corporation

333 South Grand Avenue, 28th Floor

Los Angeles, CA 90071

Virtual 2018 Joint AnnualSpecial Meeting of Stockholders

We are furnishing you this joint proxy statement in connection with the solicitation of proxies by the Boards of Directors (each, a “Board” and together, the “Boards”) of Oaktree Specialty Lending Corporation (formerly known as Fifth Street Finance Corp. through October 17, 2017, “OCSL”(“OCSL”) and Oaktree Strategic Income Corporation (formerly known as Fifth Street Senior Floating Rate Corp. through October 17, 2017, “OCSI”(“OCSI”, and OCSL and OCSI, each, a “Company” and together, the “Companies,” “we,” “us,” or “our”) for use at the Companies’ virtual 20182019 Joint AnnualSpecial Meeting of Stockholders (the “Annual“Special Meeting”).

This joint proxy statement and each Company’s Annual Report forsummarizes the fiscal year ended September 30, 2017 are being made availableinformation regarding the matters to be voted upon at the respective stockholders thereof via the Internet on or about February 9, 2018. When we refer to each Company’s fiscal year, we mean the12-month period ending September 30 of the stated year (for example, fiscal year 2017 was October 1, 2016 through September 30, 2017).

Special Meeting. We encourage you to vote your shares by following the instructions on the Notice of Internet Availability of Proxy Materialsenclosed proxy card and granting a proxy (i.e.(i.e., authorizing someone to vote your shares). If you provide voting instructions, either via the Internet, by telephone or by requesting, signing, dating and returning athe enclosed proxy card, and the Company receives them in time for the AnnualSpecial Meeting, the persons named as proxies will vote your shares in the manner that you specified.

As of May 6, 2019, the date for determining stockholders entitled to vote at the Special Meeting (the “Record Date”), 140,961,000 shares of OCSL common stock were outstanding and 29,467,000 shares of OCSI common stock were outstanding. If you owned shares of our common stock at the close of business on the Record Date, you are entitled to one vote for each share of common stock you owned as of that date. Each Company first mailed this proxy statement and the attached materials on or about May 22, 2019 to all stockholders entitled to vote their shares at the Special Meeting.

Although each Company is a separate business development company and stockholders of each Company will vote separately on the proposals contained herein, the Companies are soliciting votes through this joint proxy statement to reduce expenses to the Companies in connection with soliciting proxies for the Annual Special Meeting. Each Company’s stockholders will vote separately on the proposal(s) that such Company’s stockholders are being asked to approve.

AnnualSpecial Meeting Information

The AnnualSpecial Meeting will be held on June 28, 2019 at 10:00 a.m., Pacific Time. The Special Meeting will be a completely virtual meeting. There will be no physical meeting location and the meeting will only be conducted via live webcast. The virtual Annual Meeting will be held on April 6, 2018 at 10:00 a.m., Pacific Time. To participate in the AnnualSpecial Meeting, visit www.virtualshareholdermeeting.com/ocsl2018ocsl2019sm if you are an OCSL stockholder and/or www.virtualshareholdermeeting.com/ocsi2018ocsi2019sm if you are an OCSI stockholder and, in each case, enter the16-digit control number included in your Notice of Internet Availability of Proxy Materials, on the enclosed proxy card you received, or in the instructions that accompanied your proxy materials for the applicable Company. Onlinecheck-in will begin at 9:55 a.m., Pacific Time. Please allow time for onlinecheck-in procedures.

You are entitled to participate in the virtual AnnualSpecial Meeting only if you are a stockholder of OCSL and/or OCSIOSCI as of the close of business on the record dateRecord Date for the AnnualSpecial Meeting, which is February 9, 2018 (the “Record Date”), or if you hold a valid proxy for the AnnualSpecial Meeting.

Availability of Proxy and AnnualSpecial Meeting Materials

This 2018 joint proxy statement and the OCSL Annual Report on Form10-K for the year ended September 30, 2017 areis also available at https://www.oaktreespecialtylending.com. This 2018 joint proxy statementwww.oaktreespecialtylending.com or https://www.oaktreestrategicincome.com.

1

Overview

The Board of Directors of each Company has approved and unanimously recommends that stockholders vote FOR a proposal to approve a new investment advisory agreement between the Company and Oaktree Capital Management, L.P. (the “Adviser”), that will replace the current investment advisory agreement with the Adviser and will become effective at the closing of the Merger (defined below) (“Proposal 1”). Pursuant to a merger agreement with Brookfield Asset Management Inc. and certain of its affiliates (together, “Brookfield”), Oaktree Capital Group, LLC, the parent company of each Company’s investment adviser, and its affiliates (together, “Oaktree”) has agreed to enter into a series of contemporaneous transactions pursuant to which, Brookfield will acquire a majority economic interest in Oaktree (collectively, the “Merger”). The Merger is currently expected to close during the third quarter of 2019 (the “Closing”).

Following the Closing, Brookfield will hold an approximately 62% economic interest in Oaktree’s business and Oaktree’s founders and certain other members of Oaktree’s management and employees will own the remaining 38% economic interest in Oaktree’s business. It is currently anticipated that the board of the parent company of each Company’s investment adviser will consist of ten individuals following the Closing, eight of whom are current board members of Oaktree Capital Group, LLC and two of whom will be Brookfield representatives. Oaktree will continue to operate its business under the Oaktree name and current management will continue to manage the Oaktree business. In addition, Howard Marks, the Co-Chairman of Oaktree, is expected to join Brookfield’s board of directors following the Closing. Under the terms of the agreement between Oaktree and Brookfield, Oaktree’s current management will maintain actual control of the management of Oaktree, subject to certain limited consent rights held by Brookfield, for an “Initial Period.”1

The Companies are subject to the Investment Company Act of 1940, as amended (the “1940 Act”), which provides that any investment advisory agreement must terminate automatically upon its “assignment.” As used in the 1940 Act, the term “assignment” includes any transfer of a controlling block of outstanding voting securities of an adviser or the parent company of an adviser. Notwithstanding this definition, a transaction which does not result in a change of actual control or management of an investment adviser is not deemed an “assignment” for purposes of the 1940 Act. Oaktree has informed each Company’s Board that it does not believe the consummation of the Merger would be deemed an “assignment” of the current investment advisory agreement between each Company and the OCSI Annual ReportAdviser (each such agreement, the “Current Investment Advisory Agreement”), although such a determination is inherently uncertain. In accordance with the 1940 Act, however, the Current Investment Advisory Agreement for each Company automatically terminates upon its assignment. To prevent any potential disruption in Oaktree’s ability to provide services to each Company once an assignment is deemed to occur, whether as a result of the Merger or as a result of Brookfield exercising actual control over Oaktree, each Company is seeking stockholder approval of a new investment advisory agreement between each Company and the Adviser, (each such agreement, the “New Investment Advisory Agreement”). All material terms will remain unchanged from the Current Investment Advisory Agreement. If approved, each New Investment Advisory Agreement would become effective at the Closing and would remain effective following the conclusion of the Initial Period. If the Merger does not occur, the Adviser will continue to operate each Company pursuant to the Current Investment Advisory Agreement.

The Board of each Company, including all of the directors who are not “interested persons” of the Company, as defined in the 1940 Act (each, an “Independent Director”), has unanimously approved the New Investment Advisory Agreement and believes it to be in the best interests of the Company and its stockholders. The 1940 Act requires that the New Investment Advisory Agreement be approved by both a majority of a Company’s Independent Directors and “a majority of the outstanding voting securities” of the Company as defined in the 1940 Act. Each Company’s stockholders will vote separately on Form10-K for the year ended September 30, 2017 are also available at https://www.oaktreestrategicincome.com.applicable New Investment Advisory Agreement.

| 1 | This “Initial Period” refers to the period of time beginning on the closing date of the Merger and ending no earlier than the third business day following, at Brookfield’s election, the earliest to occur of: (a) Howard Marks and Bruce Karsh collectively ceasing to beneficially own at least 42% of the equity in Oaktree’s operating entities that they beneficially owned immediately after the closing of the Merger (which amount shall be deemed to include any charitable donations they are permitted to make prior to the closing); (b) Howard Marks and Bruce Karsh both ceasing to be actively and substantially involved in the oversight of the day-to-day affairs of the business of the Oaktree operating group, in each case for a period of at least 90 consecutive days or an aggregate of 180 calendar days in any 360-day period, except as a result of incapacitation; (c) the incapacitation of both Howard Marks and Bruce Karsh and (d) the seventh anniversary of the Closing. |

2

TABLE OF CONTENTSPurpose of Annual Meeting

In addition, to transacting such other business as may properly come before the Annual Meeting and any adjournments or postponements, at the AnnualSpecial Meeting, the respective stockholders of each CompanyOCSL will be asked to vote on a proposal to approve the following proposals asapplication of the reduced asset coverage requirements in Section 61(a)(2) of the 1940 Act to such Company:OCSL, which would permit OCSL to double the maximum amount of leverage that it is permitted to incur by reducing the asset coverage requirements applicable to OCSL from 200% to 150% (“Proposal 2”).

1. To elect two directors, eachPursuant to both the Current Investment Advisory Agreement and the New Investment Advisory Agreement, upon the effectiveness of whomthe reduced asset coverage requirements to OCSL, the base management fee payable to the Adviser will serve untilbe calculated at an annual rate of 1.50% of the 2021 Annualvalue of OCSL’s total gross assets, including any investments made with borrowings, but excluding cash and cash equivalents; provided, however, the base management fee will be calculated at an annual rate of 1.00% of the value of OCSL’s total gross assets, including any investments made with borrowings, but excluding cash and cash equivalents, that exceeds the product of (i) 200% and (ii) OCSL’s net assets. For the avoidance of doubt, the 200% will be calculated in accordance with the 1940 Act and the exemptive relief OCSL received with respect to debentures issued by a small business investment company subsidiary.

3

QUESTIONS AND ANSWERS

At the Joint Special Meeting of Stockholders of each Company to be held on June 28, 2019, you will have the opportunity to vote on the Proposal(s) that stockholders of such Company are being asked to approve. The following “Questions and Answers” are provided for your convenience. These questions and answers may not address all of the questions that are important to you. We encourage you to read carefully the more detailed information contained elsewhere in this proxy statement, the appendices to this proxy statement and the documents we refer to in this proxy statement.

What am I being asked to vote on?

At the Special Meeting, stockholders of each Company are being asked to vote for the following proposal:

Additionally, stockholders of OCSL only will also be asked to vote for the following proposal:

Who is Brookfield Asset Management?

Brookfield Asset Management Inc. is a global alternative asset manager with over $350 billion in assets under management. For 120 years Brookfield has owned and operated assets on behalf of shareholders and investors with a focus on real estate, renewable power, infrastructure and private equity. Brookfield offers a range of public and private investment products and services which leverage its expertise and experience. Brookfield class A shares are co-listed on the NYSE under the symbol “BAM”, the TSX under the symbol “BAM.A” and Euronext under the symbol “BAMA.” If the Merger is consummated both Brookfield and OCG will continue to operate their respective businesses independently, with each remaining under its current brand and led by its existing management and investment teams.

Why am I being asked to vote on the New Investment Advisory Agreement?

If a specified client consent percentage (as measured by Oaktree fee revenues calculated in accordance with the Merger Agreement) object to the Merger (as determined in accordance with the Merger Agreement) (such percentage, the “Specified Percentage”) then neither party will be obligated to complete the Merger. If the stockholders of a Company do not vote to approve its New Investment Advisory Agreement, such objection will be taken into account when determining the Specified Percentage noted above. However, even if the stockholders of a Company do not approve its New Investment Advisory Agreement the Closing may still occur. See —“What are the conditions of the Merger Agreement?” below for more information.

As detailed in “Overview” above, Oaktree does not believe the consummation of the Merger would be deemed an “assignment” of the Current Investment Advisory Agreements, although such a determination is inherently uncertain. If the consummation of the Merger were determined to result in an assignment for purposes of the 1940 Act, however, then the Current Investment Advisory Agreement for each Company would automatically terminate on the date of the Closing. To prevent any potential disruption in Oaktree’s ability to provide services to each Company once an assignment is deemed to occur, whether as a result of the Merger or until his successoras a result of Brookfield exercising actual control over Oaktree, each Company is duly electedseeking stockholder approval of a new investment advisory agreement between each Company and qualified;the Adviser, (each such agreement, the “New Investment Advisory Agreement”). All material terms will remain unchanged from the Current Investment Advisory Agreement. If approved, each New Investment Advisory Agreement would become effective at the Closing and would remain effective following the conclusion of the Initial Period.

2. To ratifyHow does each Board recommend that I vote with respect to the selectionproposal to approve the New Investment Advisory Agreement?

In evaluating the New Investment Advisory Agreement, each Board reviewed certain materials furnished separately by Oaktree and its affiliates. Each Board discussed these materials and believes the New Investment

4

Advisory Agreement is in the best interests of Ernst & Young LLPthe Company and its stockholders for the reasons described later in the proxy statement. Accordingly, after careful consideration, each Board, including each of the Independent Directors, unanimously recommends that you vote “FOR” the proposal to approve the New Investment Advisory Agreement.

Have any stockholders who own 5% or more of each Company’s outstanding stock expressed a view regarding the Proposals?

Yes. Beneficial owners holding approximately 27.1% of OCSI’s outstanding stock, including Leonard M. Tannenbaum and the Adviser, have agreed to vote in favor of Proposal 1 and beneficial owners holding approximately 17.4% of OCSL’s outstanding stock, including Leonard M. Tannenbaum and the Adviser have agreed to vote in favor of the Proposals.

Do any of the Company’s directors or officers have an interest in the approval of the New Investment Advisory Agreement that is different from that of the Company’s stockholders generally?

As described later in this proxy statement, our directors and officers have certain conflicts of interests in connection with the vote on the New Investment Advisory Agreement. See “—Proposal 1 — Merger Agreement” below for more information.

What are the conditions of the Merger Agreement?

The obligation of the parties to complete the Merger is subject to customary closing conditions, including, without limitation: (i) the adoption of the Merger Agreement by holders of Oaktree Class A Units and Class B Units, voting together as a single class, representing a majority of the voting interests in Oaktree; (ii) the absence of any order or preliminary or permanent injunction preventing the consummation of the Merger; (iii) the expiration or termination of the applicable Hart-Scott-Rodino Antitrust Improvements Act waiting period and receipt of certain other required antitrust and other regulatory approvals, including, without limitation, from the Committee on Foreign Investment in the United States; (iv) the effectiveness of the registration statement pursuant to which the Brookfield Class A Shares to be issued as part of the share consideration will be registered; (v) approval from the New York Stock Exchange for the listing of the Brookfield Class A Shares to be issued as part of the share consideration; (vi) completion of the mandatory and optional exchanges described in Unitholder Support Agreement, dated as of March 13, 2019, as it may be amended from time to time, among Brookfield, Berlin Merger Sub, LLC, OCG, Oaktree Capital Group Holdings, L.P. (“EY”OCGH”) and Oaktree Capital Group Holdings GP, LLC (the “Support Agreement”), pursuant to which certain limited partners of OCGH will exchange their units in OCGH for OCG Class A Units and (vii) calculated as of a date between 5-10 days prior to closing, investment advisory clients representing at least 82.5% of the aggregate annualized investment advisory, investment management, subadvisory or other similar recurring fees of all Oaktree investment advisory clients (based upon assets under management as of February 28, 2019), calculated in accordance with the Merger Agreement, will have consented to the transactions, as described in the Merger Agreement.

Each party’s obligation to consummate the Merger is subject to certain other conditions, including (a) the accuracy of the other party’s representations and warranties and (b) the other party’s compliance with its covenants and agreements contained in the Merger Agreement (in each case, subject to certain qualifications).

Will the Merger change how the Companies are managed?

No, the Merger is not expected to have any impact on each Company’s management or day-to-day operations for at least the duration of the Initial Period. Each Company’s existing directors and officers will continue to serve in their current roles and there is not expected to be any near-term change in the personnel providing services to the Companies. Each Company’s investment objective will remain unchanged as a result of the entry into the New Investment Advisory Agreement. After Closing, each Company will continue to be a business development company and its shares of common stock will continue to be listed on the Nasdaq Global Select Market and trade under their current ticker symbols, OCSL and OCSI. Stockholders in each Company will continue to own the same amount and type of shares in the same Company. OCSL’s name will continue to be Oaktree Specialty Lending Corporation and OCSI’s name will continue to be Oaktree Strategic Income Corporation.

5

What will happen if Proposal 1 is not approved?

If each Company’s stockholders do not approve the proposal, the Current Investment Advisory Agreement with Oaktree will remain in effect. Additionally, if the Specified Percentage objects to the Merger then neither party will be obligated to complete the Merger. If each Company’s stockholders do not vote to approve the New Investment Advisory Agreement, such objection will be taken into account when determining the Specified Percentage. If the Merger does not close for any reason, each Company will continue to operate pursuant to the Current Investment Advisory Agreement.

How will the Merger affect the service providers to each Company?

Oaktree Capital Management, L.P.

Oaktree Capital Management, L.P., a Delaware limited partnership, serves as the investment adviser to each Company.

Currently, the Adviser is an indirect, wholly owned subsidiary of Oaktree Capital Group, LLC. After Closing, the Adviser will no longer be wholly owned by Oaktree Capital Group, LLC. However, Oaktree’s current management will maintain actual control of the management of the Adviser, subject to certain limited consent rights held by Brookfield, for the Initial Period. Howard Marks and Bruce Karsh serve as co-chairmen of the Adviser, and Jay Wintrob serves as chief executive officer. Oaktree Holdings, Inc. is the general partner of the Adviser. The principal address of the Adviser, its principal executive officers and its general partner is 333 South Grand Avenue, 28th Floor, Los Angeles, CA 90071.

Oaktree Administrator

Oaktree Fund Administration, LLC, a Delaware limited liability company, (the “Oaktree Administrator”), serves as the administrator to each Company. Following the Closing, the Oaktree Administrator will continue to provide administrative services to the Companies necessary for the operations of each Company, which include providing office facilities, equipment, clerical, bookkeeping and record keeping services at such facilities and such other services as the Oaktree Administrator, subject to review by each Board, shall from time to time deem to be necessary or useful to perform its obligations under the administration agreement. The principal address of the Oaktree Administrator is 333 South Grand Avenue, 28th Floor, Los Angeles, CA 90071.

Will the management and incentive fees payable by each Company change under the New Investment Advisory Agreement?

No. For OCSI the base management fee under the New Investment Advisory Agreement will remain unchanged at 1.00% of gross assets and for OCSL the base management fee under the New Investment Advisory Agreement will remain unchanged at 1.50% of gross assets, provided, however, the base management fee will be calculated at an annual rate of 1.00% of the value of OCSL’s total gross assets, including any investments made with borrowings, but excluding cash and cash equivalents, that exceeds the product of (i) 200% and (ii) OCSL’s net assets. For the avoidance of doubt, the 200% will be calculated in accordance with the 1940 Act and the exemptive relief OCSL received with respect to debentures issued by a small business investment company subsidiary (such relief allows OCSL to exclude such debentures from the calculation of its asset coverage ratio under the 1940 Act, and thus the base management fee payable on any gross assets, excluding cash and cash equivalents, that result from such leverage would incur a base management fee at an annual rate of 1.50%). “Gross assets” includes any investments made with borrowings, but excludes any cash or cash equivalents. Additionally, the rate of the incentive fee payable on the Company’s independent registered public accounting firm forpre-incentive fee net investment income will remain at 17.5%, and the rate at which the income-based incentive fee will be earned during the “catch up” will remain at 100%. For any quarter in which the Company’s pre-incentive fee net investment income exceeds 1.8182% on net assets, the incentive fee on income is equal to 17.5% of the amount of the Company’s pre-incentive fee net investment income, as the preferred return and catch-up will have been achieved. As agreed to under the Current Investment Advisory Agreement, the capital gains-based incentive fee of 17.5% will not be charged until the fiscal year ending September 30, 2018.2019.

EACH COMPANY’S BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT YOU VOTE “FOR” EACH OF THE APPLICABLE COMPANY’S DIRECTOR NOMINEES DESCRIBED IN THE ACCOMPANYING JOINT PROXY STATEMENT AND “FOR” THE PROPOSAL TO RATIFY THE APPOINTMENT OF ERNST & YOUNG LLP AS THE INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR SUCH COMPANY FOR THE FISCAL YEAR ENDING SEPTEMBER 30, 2018.

You may cast one vote for each shareApproval of common stockProposal 2 will not affect the calculation of the applicablebase management fee or the incentive fee under the Current Investment Advisory Agreement or the New Investment Advisory Agreement with respect to leverage

6

that OCSL was permitted to incur prior to such approval. However, with respect to gross assets (excluding cash and cash equivalents) that result from incremental leverage that OCSL is permitted to incur as a result of such approval, the base management fee will be calculated at an annual rate of 1.00% rather than 1.50%.

Will each Company bear the costs associated with the Merger and this solicitation of proxies?

The Merger Agreement specifically provides that you owned asOaktree and Brookfield will each bear 50% of fees and expenses incurred in connection with the consent solicitation process, including any costs associated with this solicitation of proxies, provided that OCSL will bear its own legal expenses with respect to Proposal 2 (which is unrelated to the Merger).

Who will conduct the solicitation?

In addition to mail and e-mail, proxies may be solicited personally, via the Internet or by telephone or facsimile, by regular employees of the Record Date. SharesOaktree Administrator and its affiliates. No additional compensation will be paid to such regular employees for such services. The Oaktree Administrator has engaged Broadridge to provide certain proxy solicitation services for which it will be paid a fee of each Company’s common stock have equal voting rights as all other sharesapproximately $105,000 for OCSL and $45,000 for OCSI, which includes reimbursement of such Company’s common stock and, in each case, areout-of-pocket expenses. You could be contacted by telephone on behalf of the only classCompany of voting securities outstanding of each Company. Stockholders can vote only on matters affecting a Company in which theyyou hold shares of common stock. As of January 26, 2018, OCSL had 140,960,651stock and be urged to vote. Broadridge will not attempt to influence how you vote your shares, of common stock outstandingbut will only ask that you take the time to cast a vote. Oaktree and OCSI had 29,466,768 shares of common stock outstanding.

For a Company to conduct business atBrookfield will reimburse brokers and other persons holding the Annual Meeting, a quorum of stockholders of that Company must be present at the Annual Meeting. The presence at the Annual Meeting, virtually or by proxy, of the holders of a majority of the shares of a Company’s common stock outstanding on the Record Date will constitute a quorum of such Company. Abstentions will be treated as shares present for quorum purposes. Shares for which brokers have not received voting instructions from the beneficial owner of the shares and do not have discretionary authority to vote on certain proposals (which are considered “brokernon-votes” with respect to such proposals) will be treated as shares present for quorum purposes.

The Chairman of each Company shall have the power to adjourn such Company’s Annual Meeting, whetherin their names, or not a quorum is present, from time to time for any reason and without notice other than announcement at the Annual Meeting.

Submitting Voting Instructions for Shares Held Through a Broker, Bank, Trustee or Nominee

If you hold shares of a Company’s common stock through a broker, bank, trustee or nominee, you must follow the voting instructions you receive from your broker, bank, trustee or nominee. If you hold shares of a Company’s common stock through a broker, bank, trustee or nominee and want to participate in the virtual Annual Meeting, you must follow the instructions younames of nominees, for their expenses for forwarding proxy materials to principals and beneficial owners and obtaining their proxies.

What does it mean if I receive from your broker, bank, trustee or nominee.Please instruct your broker, bank, trustee or nominee so your vote can be counted.

Brokers, banks, trustees and nominees have discretionary authority to vote on “routine” matters, but not on“non-routine” matters. The “routine” matter being considered by each Company at this Annual Meeting is the ratification of the appointment of such Company’s independent registered public accounting firm, and the“non-routine” matter being considered by each Company at this Annual Meeting is the election of directors. If you hold your shares in street name (or “nominee name”) and do not provide your broker, bank, trustee or nominee who holds such shares of record with specific instructions regarding how to vote on each Company’s proposal to elect director(s), your broker may not be permitted to vote your shares on such“non-routine” proposals.

Please note that to be sure your vote is counted on a Company’s proposal to elect director(s), you should instruct your broker, bank, trustee or nominee how to vote your shares. If you do not provide voting instructions, votes may not be cast on your behalf with respect to such proposals.

Authorizing a Proxy for Shares Held in Your Name

If you are a record holder of shares of a Company’s common stock, you may authorize amore than one proxy to vote on your behalf by following the instructions provided on the Notice of Internet Availability of Proxy Materials. Authorizing your proxy will not limit your right to participate in the virtual Annual Meeting and vote your shares online. A properly completed and submitted proxy will be voted in accordance with your instructions unless you subsequently revoke your instructions. If you authorize a proxy without indicating your voting instructions, the proxyholder will vote your shares according to the applicable Board’s recommendations. Internet and telephone voting procedures are designed to authenticate the stockholder’s identity and to allow stockholders to vote their shares and confirm that their instructions have been properly recorded. Your Internet or telephone vote authorizes the named proxies to vote your shares in the same manner as if you had marked, signed and returned a proxy card.

Receipt of Multiple Proxy Cardscard?

Some of each Company’s stockholders hold their shares in more than one account and may receive a separate Notice of Internet Availability of Proxy Materialsproxy card for each of those accounts. To ensure that all of your shares are represented at the AnnualSpecial Meeting, we recommend that you vote by following the instructions in each Notice of Internet Availability of Proxy Materialsproxy card you receive.

Revoking Your ProxyMay I revoke my proxy?

Yes. If you are a stockholder of record of OCSL and/or OCSI, you can revoke your proxy as to either or both Companies at any time before it is exercised by: (i) delivering a written revocation notice that is received prior to the AnnualSpecial Meeting to Oaktree Specialty Lending Corporation or Oaktree Strategic Income Corporation, as applicable, 333 South Grand Avenue, 28th28th Floor, Los Angeles, CA 90071, Attention: Secretary; (ii) submitting a later-dated proxy that we receive before the conclusion of voting at the AnnualSpecial Meeting; or (iii) participating in the virtual AnnualSpecial Meeting and voting online. If you hold shares of a Company’s common stock through a broker, bank, trustee or nominee, you must follow the instructions you receive from them in order to revoke your voting instructions. Participating in the virtual AnnualSpecial Meeting does not revoke your proxy unless you also vote online at the AnnualSpecial Meeting.

Votes RequiredWhat is the difference between holding shares as a stockholder of record and as a beneficial owner?

ElectionStockholders of directors.Record The. You are a stockholder of record if at the close of business on the Record Date your shares were registered directly in your name with our transfer agent, American Stock Transfer & Trust Company, LLC.

Beneficial Owner. You are a beneficial owner if at the close of business on the Record Date your shares were held by a broker, bank, trustee or nominee and not in your name. Being a beneficial owner means that your shares are held in “street name.” As the beneficial owner, you have the right to direct your broker, bank, trustee or nominee how to vote your shares by following the voting instructions your broker, bank, trustee or nominee provides. If you do not provide your broker, bank, trustee or nominee with instructions on how to vote your shares, your broker, bank, trustee or nominee will not be able to vote your shares with respect to any of the proposals.

What will happen if I do not vote my shares?

Stockholders of Record. If you are the stockholder of record of your shares and you do not vote by proxy card, via telephone or the Internet or during the Special Meeting, your shares will not be voted at the Special Meeting.

7

Beneficial Owners. Brokers, banks, trustees and nominees have discretionary authority to vote on “routine” matters, but not on “non-routine” matters. There are no “routine” matters being considered at the Special Meeting. If you hold your shares in street name (or “nominee name”) and do not provide your broker, bank, trustee or nominee who holds such shares of record with specific instructions regarding how to vote on the applicable Company’s proposal(s), your broker will not be permitted to vote your shares at the Special Meeting.

What is the vote required for each proposal?

Proposal 1. For each Company, approval of Proposal 1 requires the affirmative vote of a plurality“majority of the outstanding voting securities” of such Company. Under the 1940 Act, a “majority of the outstanding voting securities” means the affirmative vote of the lesser of (a) 67% or more of the shares of a Company’s common stock outstanding and entitled to vote thereonthe Company present or represented by proxy at the AnnualSpecial Meeting is required to elect each director nomineeif the holders of that Company (i.e.,more than 50% of the candidates receivingoutstanding shares are present or represented by proxy at the most “for” votes will win each election). Stockholders may not cumulate their votes. Votes to “withhold authority”Special Meeting or (b) more than 50% of the outstanding shares of the Company. Abstentions and brokernon-votes, will not be included in determining the number of votes cast and, as a result, if any, will have nothe effect onof a vote against this proposal.

Ratification of independent registered public accounting firm.Proposal 2. The affirmative vote of a majority of a Company’sOCSL’s votes cast atduring the AnnualSpecial Meeting or by proxy is required to ratify the appointment of EY to serve as such Company’s independent registered public accounting firmapprove Proposal 2 (i.e., the number of shares voted “for” the ratificationapproval of the appointmentapplication of EYthe reduced asset coverage requirements in Section 61(a)(2) of the 1940 Act to OCSL exceeds the number of votes “against” the ratificationapplication of the appointmentreduced asset coverage requirements in Section 61(a)(2) of EY)the 1940 Act to OCSL). Abstentions and brokernon-votes, if any, will not be included in determining the number of votes cast and, as a result, will have no effect on this proposal.Proposal 2.

Information Regarding This Solicitation

Each Company will bear its allocable portionHow do I find out the results of the expensesvoting at the Special Meeting?

Preliminary voting results will be announced at the Special Meeting. Final voting results will be published in a current report on Form 8-K within four business days from the date of the solicitationSpecial Meeting.

Who should I call if I have any questions?

If you have any questions about the Special Meeting, voting or your ownership of proxies. In addition to mail ande-mail, proxies may be solicited personally, via the Internet or by telephone or facsimile, by regular employees of Oaktree Fund Administration, LLC (“Oaktree Administrator”), the Companies’ administrator, and its affiliates and/or a paid solicitor. No additional compensation will be paid to such regular employees for such services. If the Companies retain a solicitor, the Companies have estimated that they will pay an aggregate of approximately $5,000 plusout-of-pocket expenses for such services. If the Companies engage a solicitor, you could be contacted by telephone on behalf of your Company and be urged to vote. The solicitor will not attempt to influence how you vote your shares, but will only ask that you take the time to cast a vote. Each Company will reimburse brokers and other persons holding such Company’s common stock, in their names, or in the names of nominees,please contact: Broadridge Investor Communication Solutions, Inc. (“Broadridge”), toll-free at (844) 557-9030 for their expensesOCSL and (855) 643-7307 for forwarding proxy materials to principals and beneficial owners and obtaining their proxies. The principal address of Oaktree Administrator is 333 South Grand Avenue, 28th Floor, Los Angeles, CA 90071.OCSI.

8

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth, as of January 26, 2018,May 6, 2019, the beneficial ownership information of each current director, including the nominees for director of both Companies, as well as each Company’s executive officers, each person known to it to beneficially own 5% or more of the outstanding shares of its common stock, and the executive officers and directors as a group. Percentage of beneficial ownership is based on 140,960,651 shares of OCSL’s common stock and 29,466,768 shares of OCSI’s common stock outstanding as of January 26, 2018.May 6, 2019.

Beneficial ownership is determined in accordance with the rules of the Securities and Exchange Commission (“SEC”) and includes voting or investment power with respect to the securities. Ownership information for those persons who beneficially own 5% or more of the shares of a Company’s common stock is based upon filings by such persons with the SEC and other information obtained from such persons, if available.

Unless otherwise indicated, the Companies believe that each beneficial owner set forth in the table below has sole voting and investment power over the shares beneficially owned by such beneficial owner. The directors are divided into two groups — interested director and independent directors. The interested director is an “interested person” of each Company as defined in Section 2(a)(19) of the Investment Company Act of 1940 as amended (the “1940 Act”).Act. The address of all executive officers and directors is c/o Oaktree Specialty Lending Corporation or c/o Oaktree Strategic Income Corporation, as applicable, 333 South Grand Avenue, 28th Floor, Los Angeles, CA 90071.

| Number of Shares of Common Stock Owned Beneficially | Percentage of Company Common Stock Outstanding | |||||||||||||||

Name (Company or Companies) | OCSL | OCSI | OCSL | OCSI | ||||||||||||

Interested Director: | ||||||||||||||||

John B. Frank (OCSL; OCSI) | 28,784 | 11,876 | * | * | ||||||||||||

Independent Directors: | ||||||||||||||||

Richard Cohen (OCSI) | N/A | 33,025 | N/A | * | ||||||||||||

Richard P. Dutkiewicz (OCSL)(1) | 29,738 | N/A | * | N/A | ||||||||||||

Marc H. Gamsin (OCSL; OCSI) | — | — | — | — | ||||||||||||

Craig Jacobson (OCSL; OCSI) | 31,200 | 17,600 | * | * | ||||||||||||

Richard G. Ruben (OCSL; OCSI) | 30,250 | 23,000 | * | * | ||||||||||||

Bruce Zimmerman (OCSL; OCSI) | 10,000 | 6,000 | * | * | ||||||||||||

Executive Officers: | ||||||||||||||||

Mel Carlisle (OCSL; OCSI) | — | — | — | — | ||||||||||||

Kimberly Larin (OCSL; OCSI) | — | — | — | — | ||||||||||||

Edgar Lee (OCSL; OCSI) | 12,000 | 6,000 | * | * | ||||||||||||

Mathew Pendo (OCSL; OCSI) | 12,000 | 6,000 | * | * | ||||||||||||

All Executive Officers and Directors as a Group(2) | 153,972 | 103,501 | * | * | ||||||||||||

5% Holders | ||||||||||||||||

Senvest Management, LLC(3) | 7,158,959 | — | 5.08 | % | — | |||||||||||

Oaktree Capital Management, L.P.(4) (5) | 25,910,813 | 7,956,767 | 18.4 | % | 27.0 | % | ||||||||||

Leonard M. Tannenbaum(6) (7) | 25,634,813 | 7,899,167 | 18.2 | % | 26.8 | % | ||||||||||

Number of Shares of Common Stock Owned Beneficially | Percentage of Company Common Stock Outstanding | |||||||||||

Name (Company or Companies) | OCSL | OCSI | OCSL | OCSI | ||||||||

Interested Director: | ||||||||||||

John B. Frank (OCSL; OCSI)(1)(2) | 53,634 | 57,376 | * | * | ||||||||

Independent Directors: | ||||||||||||

Deborah Gero (OCSL; OCSI) | — | — | * | * | ||||||||

Craig Jacobson (OCSL; OCSI) | 70,600 | 40,975 | * | * | ||||||||

Richard G. Ruben (OCSL; OCSI) | 30,250 | 30,667 | * | * | ||||||||

Bruce Zimmerman (OCSL; OCSI) | 37,000 | 15,250 | * | * | ||||||||

Executive Officers: | ||||||||||||

Mel Carlisle (OCSL; OCSI) | 10,000 | 6,000 | * | * | ||||||||

Kimberly Larin (OCSL; OCSI) | — | — | ||||||||||

Edgar Lee (OCSL; OCSI) | 12,000 | 6,000 | * | * | ||||||||

Mathew Pendo (OCSL; OCSI) | 19,050 | 9,650 | * | * | ||||||||

All Executive Officers and Directors as a Group(3) | 232,534 | 165,918 | * | * | ||||||||

5% Holders: | ||||||||||||

Springhouse Capital (Master), L.P.(4) | 7,268,454 | — | 5.2 | % | — | |||||||

Leonard M. Tannenbaum(5)(6) | 24,203,623 | 7,607,635 | 17.2 | % | 25.8 | % | ||||||

Oaktree Capital Management, L.P.(7)(8) | 24,479,623 | 7,988,760 | 17.4 | % | 27.1 | % | ||||||

| * | Represents less than 1% |

| (1) |

| (2) | Of the 57,376 shares of OCSI common stock listed as |

| Amount only includes Section 16(a) reporting persons of the Companies. |

Based on a Schedule |

| the SH General Partner’s position as general partner of the Fund, the SH Manager’s position as investment manager of |

9

| (5) |

| The address for Leonard M. Tannenbaum is |

| As reported on the Schedule 13D/A filed by Mr. Tannenbaum on September 26, 2018 and the Form 4 filed by Mr. Tannenbaum on |

As indicated above, one of OCSL’s directors holds shares in margin accounts. As of January 26, 2018, no shares in such margin accounts were pledged as loan collateral. Each Company’s securities trading policy permits share pledges in limited cases with thepre-approval of such Company’s chief compliance officer.

| (7) | The address for the Adviser is 333 South Grand Avenue, 28th Floor, Los Angeles, CA 90071. As reported on a Schedule 13D/A filed by Oaktree on November 1, 2017, a Schedule 13D/A filed by Mr. Tannenbaum on April 12, 2019 and a Form 4 filed by the Adviser on December 15, 2017, of the OCSL shares over which the Adviser has shared voting and dispositive power, (i) 276,000 shares of OCSL common stock are held by Oaktree Capital I, L.P. and (ii) the Adviser may be deemed to beneficially own 24,203,623 shares of OCSL common stock pursuant to a voting agreement by and among the Adviser, FSH, Leonard M. Tannenbaum, the Leonard M. Tannenbaum Foundation, the Tannenbaum Family 2012 Trust and 777 West Putnam Avenue LLC. |

| (8) | As reported on a Schedule 13D/A filed by the Adviser on October 19, 2018, a Schedule 13D/A filed by Mr. Tannenbaum on September 26, 2018 and a Form 4 filed by Mr. Tannenbaum on May 7, 2019, of the OCSI shares over which Oaktree has shared voting and dispositive power, (i) 392,000 shares of OCSI common stock are held by Oaktree Capital I, L.P. and (ii) the Adviser may be deemed to beneficially own 7,596,760 shares of OCSI common stock pursuant to a voting agreement by and among the Adviser, FSH, Leonard M. Tannenbaum, the Leonard M. Tannenbaum Foundation and the Tannenbaum Family 2012 Trust. |

The following table sets forth, as of January 26, 2018,May 6, 2019, the dollar range of our equity securities that is beneficially owned by each of the current directors of each Company.

Name (Company or Companies) | Dollar Range of Equity Securities Beneficially Owned(1)(2) | ||||||||

Interested Director: | OCSL | OCSI | |||||||

John B. Frank (OCSL; OCSI) | Over $100,000 | Over $100,000 | |||||||

Independent Directors: | |||||||||

Deborah Gero (OCSL; OCSI) | none | none | |||||||

| |||||||||

| |||||||||

Craig Jacobson (OCSL; OCSI) | Over $100,000 | Over $100,000 | |||||||

Richard G. Ruben (OCSL; OCSI) | Over $100,000 | Over $100,000 | |||||||

Bruce Zimmerman (OCSL; OCSI) | Over $100,000 | Over $100,000 | |||||||

| (1) | Beneficial ownership has been determined in accordance with Rule16a-1(a)(2) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). |

| (2) | The dollar range of equity securities beneficially owned |

| Market (“Nasdaq”). The dollar range of equity securities beneficially owned are: none, $1 – $10,000, $10,001 – $50,000, $50,001 – $100,000, or over $100,000. |

In addition, two of our Independent Directors, Messrs. Jacobson and Ruben, each has greater than $100,000 of investments in certain private funds managed by Oaktree and its affiliates.

10

PROPOSAL 1 — ELECTIONAPPROVAL OF DIRECTORSNEW INVESTMENT ADVISORY AGREEMENT

Background

Following the Closing, Brookfield will hold an approximately 62% economic interest in Oaktree’s business and Oaktree’s founders and certain other members of Oaktree’s management and employees will own the remaining 38% economic interest in Oaktree’s business. It is currently anticipated that the board of the parent company of our investment adviser will consist of ten individuals following the Closing, eight of whom are current board members of Oaktree Capital Group, LLC and two of whom will be Brookfield representatives. Oaktree will continue to operate its business under the Oaktree name and current management will continue to manage the Oaktree business. In addition, Howard Marks, the Co-Chairman of Oaktree, is expected to join Brookfield’s board of directors following the Closing.

The business and affairsCompanies are subject to the 1940 Act, which provides that any investment advisory agreement must terminate automatically upon its “assignment.” As used in the 1940 Act, the term “assignment” includes any transfer of a controlling block of outstanding voting securities of an adviser or the parent company of an adviser. Notwithstanding this definition, a transaction which does not result in a change of actual control or management of an investment adviser is not deemed an “assignment” for purposes of the 1940 Act.

The transaction has been structured so that Oaktree’s current management will maintain actual control of the management of Oaktree, subject to certain limited consent rights held by Brookfield, for the Initial Period. As a result, Oaktree has informed each Company’s Board that it does not believe the consummation of the Merger would be deemed an “assignment” of the Current Investment Advisory Agreements under the 1940 Act, although such a determination is inherently uncertain. In accordance with the 1940 Act, however, the Current Investment Advisory Agreement for each Company automatically terminates upon its assignment. To prevent any potential disruption in Oaktree’s ability to provide services to each Company once an assignment is deemed to occur, whether as a result of the Merger or as a result of Brookfield exercising actual control over Oaktree, each Company is managed underseeking stockholder approval of a new investment advisory agreement between each Company and the oversightAdviser, (each such agreement, the “New Investment Advisory Agreement”). All material terms will remain unchanged from the Current Investment Advisory Agreement. If approved, each New Investment Advisory Agreement would become effective at the Closing and would remain effective following the conclusion of its Board. Each Board currently consiststhe Initial Period.

The 1940 Act requires that a new investment advisory agreement be approved by both a majority of six members, of whom fivean investment company’s directors who are not “interested persons” and “a majority of the outstanding voting securities,” as such terms are defined under the 1940 Act.

If the Merger does not occur, each Company will continue to operate pursuant to the Current Investment Advisory Agreement.

Prior to the May 3, 2019 in person meeting of the Boards, each Board was provided materials regarding both the Current Investment Advisory Agreement and the New Investment Advisory Agreement. Each Board discussed whether it would be in the best interests of the Company to approve the New Investment Advisory Agreement, to take effect in connection with the closing of the Merger. Each Board, including all of the Independent Directors, unanimously approved the New Investment Advisory Agreement and recommended that the New Investment Advisory Agreement be submitted to each Company’s stockholders for approval at the Special Meeting.

The stockholders of each Company are being asked at the Special Meeting to approve the New Investment Advisory Agreement between the Company and Oaktree for an initial term of two years. If the Company enters into the New Investment Advisory Agreement upon the closing of the Merger, the Current Investment Advisory Agreement would be terminated at such time.

Each Board believes that the approval of the New Investment Advisory Agreement is in the best interest of the Company and its stockholders and will benefit the Company. Each Company’s investment objective will remain unchanged as a result of the entry into the New Investment Advisory Agreement.

Following the completion of the Merger: (i) OCSL’s name will continue to be Oaktree Specialty Lending Corporation: (ii) OCSL will continue to be a business development company, (iii) stockholders of OCSL will still own the same amount and type of shares in the Company, (iv) the shares of common stock of OCSL will continue to be listed on the Nasdaq Global Select Market and (v) OCSL’s ticker symbol will remain “OCSL.”

11

Following the completion of the Merger: (i) OCSI’s name will continue to be Oaktree Strategic Income Corporation: (ii) OCSI will continue to be a business development company, (iii) stockholders of OCSI will still own the same amount and type of shares in the Company, (iv) the shares of common stock of OCSI will continue to be listed on the Nasdaq Global Select Market and (v) OCSI’s ticker symbol will remain “OCSI.”

If each Company and Oaktree do not enter into the New Investment Advisory Agreement, the Current Investment Advisory Agreement and the administration agreement with each Company, dated October 17, 2017 (the “Current Administration Agreement”) will remain in place, and the Company’s management will remain unchanged.

Merger Agreement

The Merger Agreement provides that Brookfield will acquire a majority economic interest in Oaktree. The obligation of the parties to complete the Merger is subject to customary closing conditions, including, without limitation (i) the adoption of the Merger Agreement by holders of Oaktree Capital Group, LLC’s Class A Units and Class B Units, voting together as a single class, representing a majority of the voting interests in Oaktree; (ii) the absence of any order or preliminary or permanent injunction preventing the consummation of the Merger; (iii) the expiration or termination of the applicable Hart-Scott-Rodino Antitrust Improvements Act waiting period and receipt of certain other required antitrust and other regulatory approvals, including, without limitation, from the Committee on Foreign Investment in the United States; (iv) the effectiveness of the registration statement pursuant to which the Brookfield Class A Shares to be issued as part of the share consideration will be registered; (v) approval from the New York Stock Exchange for the listing of the Brookfield Class A Shares to be issued as part of the share consideration; (vi) the completion of the mandatory and optional exchanges described in the Support Agreement, pursuant to which certain limited partners of OCGH will exchange their units in OCGH for Class A Units of Oaktree Capital Group, LLC and (vii) calculated as of a date between 5-10 days prior to closing, investment advisory clients representing at least 82.5% of the aggregate annualized investment advisory or similar fees of all Oaktree investment advisory clients (based upon assets under management as of February 28, 2019) calculated in accordance with the Merger Agreement, will have consented to the transactions, as described in the Merger Agreement. Each party’s obligation to consummate the Merger is subject to certain other conditions, including (a) the accuracy of the other party’s representations and warranties and (b) the other party’s compliance with its covenants and agreements contained in the Merger Agreement (in each case, subject to certain qualifications).

If a specified percentage of Oaktree’s clients (as measured by fee revenues calculated in accordance with the Merger Agreement) object to the Merger then neither party will be obligated to complete the Merger. If the Company’s stockholders do not vote to approve the New Investment Advisory Agreement, such objection will be taken into account when determining the specified consent percentage noted in (vii) above.

Each Board has been informed that Brookfield and Oaktree will use reasonable best efforts to assure compliance with the conditions of Section 15(f) of the 1940 Act with respect to each Company from and after the Closing, which provides that when a sale of securities or a controlling interest in an investment adviser occurs, the investment adviser or any of its affiliated persons cannot receive any amount or benefit in connection with the sale unless two conditions are satisfied: (1) for three years following the consummation of the Merger, at least seventy-five percent (75%) of the Board of each Company must not be “interested persons” (as such term is defined in Section 2(a)(19) of the 1940 Act. Each Board may modify its numberAct) of members in accordance withOaktree Capital Management, L.P., and (2) during the applicable Company’s bylaws, except that no decrease intwo years after the number of directors shall shorten the term of any incumbent director. The NASDAQ Global Select Market (“NASDAQ”) requires that each Company maintain a majority of independent directors on its Board and provides that a director of a business development company is considered to be independent if he or she is notMerger, an “interested person”, as defined in Section 2(a)(19) of the 1940 Act. Therefore, under both the 1940 Act and applicable NASDAQ rules, a majority of the directors of each of the Boards is independent.

Under the restated certificate of incorporation of each of OCSL and OCSI, directors are divided into three classes. At each annual meeting of stockholders of each Company, the successors to the directors whose terms expire at such meeting will be elected to hold office for a term expiring at the annual meeting of stockholders held in the third year following the year of his or her election or until his or her successor has been duly elected and qualified or any director’s earlier resignation, death or removal.

Messrs. Gamsin and Jacobson have been nominated forre-election to the Board of each of OCSL and OCSI for three-year terms expiring at the 2021 Annual Meeting of Stockholders of such Company. At OCSL’s Special Meeting of Stockholders on September 7, 2017, Messrs. Gamsin and Jacobson were elected to OCSL’s Board for a term commencing on October 17, 2017. At OCSI’s Special Meeting of Stockholders on September 7, 2017, Messrs. Gamsin and Jacobson were elected to OCSI’s Board for a term commencing on October 17, 2017.

No person being nominated by either Company as a director is being proposed for election pursuant to any agreement or understanding between any such person and that Company.

Any stockholder of OCSL or OCSI can vote for or withhold on each of the director nominees of OCSL or OCSI, respectively. Votes to “withhold authority” and brokernon-votes will“unfair burden” must not be included in determining the number of votes cast and, as a result, will have no effectimposed on the election of the director nominees. In the absence of instructions to the contrary, it is the intention of the persons named as proxies to vote such proxyFOR the election of the nominees named above. If a nominee should decline or be unable to serve as a director, it is intended that the proxy will be voted for the election of such person nominated by the applicable Board as a replacement. Neither Board has any reason to believe that any director nominee named will be unable or unwilling to serve.

Each Company’s Board unanimously recommends a vote “FOR” each of the applicable Company’s director nominees described in this joint proxy statement.

Director and Executive Officer Information

Information regarding each Company’s nominees for election as a director at the Annual Meeting and each Company’s continuing directors is as follows:

|

|

|

|

| ||||

| ||||||||

|

| |||||||

| ||||||||

| ||||||||

| ||||||||

|

| |||||||

|

|

|

|

| ||||

|

| |||||||

|

| |||||||

|

| |||||||

Biographical information regarding each Company’s directors is set forth below. We have divided the directors into two groups — independent director and interested directors. The interested director is an “interested person” of each Company, as defined in Section 2(a)(19) of the 1940 Act.

The following persons serve as each Company’s executive officers in the following capacities:

|

|

|

| |||

| ||||||

| ||||||

|

|

|

| |||

| ||||||

| ||||||

Richard W. Cohen. Mr. Cohen has been a member of the OCSI Board since April 2016. Mr. Cohen is a partner of Lowey Dannenberg, P.C. (“Lowey”), a law firm that represents investors and directors in public companies, includingclosed-end funds. Mr. Cohen joined Lowey as an attorney in 1998 and served as the President of Lowey from 2008 to 2014. Mr. Cohen was a director of Crossroads Capital, Inc., a business development company, from July 2015 to June 2016 and served as a member of the valuation, audit and nominating committees. Mr. Cohen also served as a director of MGT Capital Company, a holding company, where he was also a member of its audit committee, from 2012 to 2013. Mr. Cohen is admitted to practice law in New York and Pennsylvania, and the bars of the U.S. Supreme Court, the U.S. Courts of Appeals for the 1st, 2nd, 3rd and 6th Circuits, and the U.S. District Courts for the Southern and Eastern Districts of New York, the Eastern District of Michigan and the Eastern District of Pennsylvania. Mr. Cohen received his undergraduate degree from Georgetown University and his Juris Doctor from the New York University School of Law. Mr. Cohen is a member of the National Board of Governors of the American Jewish Committee (AJC) and is the Regional President of AJC Westchester/Fairfield.

Mr. Cohen’s long experience with public company and business development company legal matters have made him a valuable contributor to OCSI Board deliberations.

Richard P. Dutkiewicz. Mr. Dutkiewicz has been a member of the OCSL Board since February 2010. He is an independent financial and operational adviser that works directly with private equity sponsors and hedge funds on their portfolio companies. These sponsors include Greenlight Capital Inc., KKR & Co. L.P., Sun Capital Partners, Inc. and ACON Investments, L.L.C. Prior to his current position, he was affiliated with Capital Insight, LLC, a private investment bank, from March 2013 to November 2013. Previously, he was affiliated with Exxedus Capital Partners from September 2012 to March 2013.

Mr. Dutkiewicz served as a member of the OCSI Board from May 2013 to October 2017. From May 2010 to April 2013, Mr. Dutkiewicz served on the board of directors of Motor Sport Country Club Holdings, Inc., which sells balancing technology for rotating devices in the automotive industry. From April 2010 to March 2012, Mr. Dutkiewicz was the executive vice president and chief financial officer of Real Mex Restaurants, Inc., which filed for bankruptcy in October 2011. Mr. Dutkiewicz previously served as chief financial officer of Einstein Noah Restaurant Group, Inc. from October 2003 to April 2010. From May 2003 to October 2003, Mr. Dutkiewicz was vice president-information technology of Sirenza Microdevices, Inc. In May 2003, Sirenza Microdevices, Inc. acquiredVari-L Company, Inc. From January 2001 to May 2003, Mr. Dutkiewicz was vice president-finance and chief financial officer ofVari-L Company, Inc. From April 1995 to January 2001, Mr. Dutkiewicz was vice president-finance, chief financial officer, secretary and treasurer of Coleman Natural Products, Inc., located in Denver, Colorado. Mr. Dutkiewicz’s previous experience includes senior financial management positions at Tetrad Corporation, MicroLithics Corporation and various divisions of United Technologies Corporation. Mr. Dutkiewicz began his career as an Audit Manager at KPMG LLP. Mr. Dutkiewicz received a B.B.A. degree from Loyola University of Chicago and passed the CPA exam in 1978.

Through his prior experiences as a vice president and chief financial officer at several public companies, including executive vice president and chief financial officer of Real Mex Restaurants, Inc. and chief financial officer of Einstein Noah Restaurant Group, Inc., Mr. Dutkiewicz brings business expertise, finance and audit skills to his Board service with OCSL. Mr. Dutkiewicz’s expertise, experience and skills closely align with OCSL’s operations, and his prior investment experience with managing public companies facilitates anin-depth

understanding of our investment business. Moreover, due to Mr. Dutkiewicz’s knowledge of and experience in finance and accounting, the OCSL Board determined that Mr. Dutkiewicz is an “audit committee financial expert” as defined under SEC rules. The foregoing qualifications led to the OCSL Board’s conclusion that Mr. Dutkiewicz should serve as a member of the OCSL Board.